Summary 摘要

Roku is poised to outperform when the bear market ends and a new bull market begins. 在熊市结束,牛市启动时,Roku 会表现得更好。

The company dominates market share for streaming platforms. 该公司主导了流媒体市场份额。

Roku's above-average growth is likely to continue as consumers continue to 'cut the cord' in favor of streaming. Roku 高于平均速度的增长可能会继续,因为消费者继续”切断绳索“,这有利于/转向 流媒体。

If you are looking for a stock that is likely to significantly outperform the S&P 500 (NYSEARCA:SPY) in the 2020s once a new bull market begins, then Roku (NASDAQ:ROKU) is one to consider. Roku's stock did take a sizable fall over the last few months which was larger than the market's decline. However, this creates a better buying opportunity since the company is set for strong long-term growth. Roku is benefiting from the trend of the cancellation of traditional cable TV services ('cord-cutting') in favor of TV/movie streaming platforms.

如果你在寻找一个在 21 世纪 20 年代,当牛市开始后,明显好于标普 500 的股票,Roku 是一个值得考虑的对象。Roku 的股票,在过去几个月,相比市场的衰退,有一个更大跌幅。这就提供了一个很好的买入机会,因为该公司有着长期强劲的增长。Roku 在 传统有限电视服务(”切断绳索“) 转向 电视/电影 流媒体平台的趋势中得益。

Dominating Streaming Platform / 主导流媒体平台

Roku dominates market share for streaming media platforms. Roku has about 39% market share, ahead of Amazon's (NASDAQ:AMZN) 30% share from Fire TV. This demonstrates Roku's attractiveness in the eyes of consumers for streaming. Roku beat out large companies such as Amazon, Apple (NASDAQ:AAPL), and Google (NASDAQ:GOOG) (NASDAQ:GOOGL) for streaming platforms.

Roku 在流媒体市场占据主导地位。它大概占 39% 的份额,领先于亚马逊公司Fire TV产品占据的 30%份额。这说明 Roku 在流媒体市场中获得了顾客的青眯。在这个市场上,Roku 击败了如亚马逊、苹果、Google 这些大公司。

Another important statistic is that Roku also dominates the market for programmatic ad market share at 59%. This means that Roku is getting the most revenue for video ads on its platform as compared to other companies. Amazon has the 2nd highest ad market share at just 19%. So, again, Roku demonstrated its ability to outperform larger companies. That should help the company continue its growth in existing regions and into new regions.

另一个重要的统计,是 Roku 在程序化广告也占据主导地位,约 59%。这意味着相比其它公司,Roku 能在它的平台上获取最大化的视频广告收入。亚马逊有着第二大的市场份额,但仅仅是 19%。所以,Roku 再一次证明了它有能力成为更大的公司。这些能帮助公司在已拓展的地区和新进入的地区,能继续的发展。

The reason for Roku's success is a result of the user-friendly format for the company's streaming platform. Consumers without smart TVs can purchase one of Roku's streaming devices. Roku also secured licensing deals with smart TV manufacturers. Roku now has 15 brands that integrated the company's streaming platform into their smart TVs.

Roku 成功的原因,是公司流媒体平台对用户体验友好的结果。没有智能电视的顾客,可以买一个 Roku 流媒体设备。Roku 还与智能电视厂商达成授权交易。现在 Roku 和 15 个品牌的厂商合作,把流媒体平台集成到智能电视中。

Roku's Above Average Growth Roku / 高于平均水平的增长

The main driver for Roku's stock to outperform the broader market is likely to be the company's above-average revenue and earnings growth. Granted, Roku is not yet profitable. However, the gross margin has been increasing as advertising revenue has increased. The company is on track for profitability in about 2022.

Roku 的股价超过大盘的主要驱动力,可能是公司超越平均水平的收入和收益增长。当然,Roku 还没有盈利。但是它的毛利润一直在增长,因为广告收入已经在增长了。预计 2022 年,公司会取得盈利。

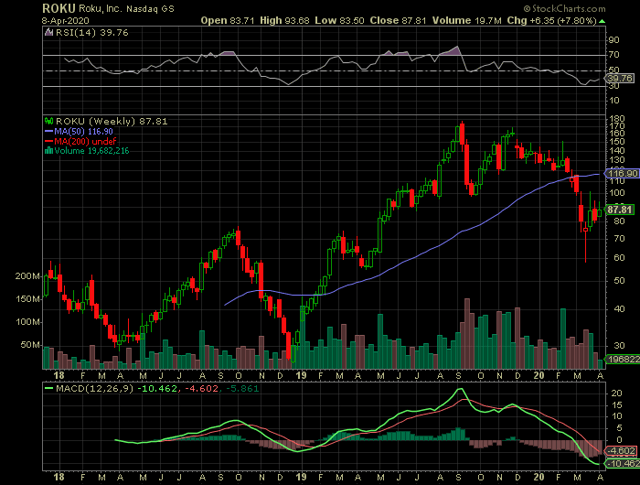

The stock has been an outperformer during the bull market as it increased from the low $20s up to the $170s from the IPO in 2017 to the stock's peak in September 2019. However, the stock did have a tendency to experience sharp declines of over 50% multiple times during this period. So, investors might want to consider trading in and out of the stock on oversold and overbought conditions. Otherwise, you would have to have a strong stomach to hold the stock over the long term.

该股票在牛市已经超越大盘,自 2017 年 IPO 到股价高点2019 年的 9 月,股价从 20 美元的低点,涨到 170 美元。然而,在这期间公司股价多次大幅下跌超过 50%。所以投资者在超卖和超买的情况可能会考虑买入和卖出股票。除非,你有一个很强大的内心,在很长一段时间内买定离手。

Roku's revenue growth is expected to exceed 30% annually for 2020 through 2022 (consensus). Of course, those estimates could change because of the uncertainty of the impact of COVID-19. The good news is that consumers are limited to what they can do at home during the shutdowns. Streaming TV shows and movies are among the activities that are available. Therefore, the COVID-19 situation may not have a significant negative impact on Roku's revenue as compared to many other businesses.

从 2020 年到 2022 年,Roku 的年收入增长预计会超过 30%。当然,这些预估在新冠疫情的影响下会有变化。好消息是,在停工期间消费者们在家里会限制活动。但他们能观看流媒体电视节目和电影。因此,相对很多其他行业,新冠疫情对 Roku 可能并不会带来很强烈的负面影响。

Profitability is on the way as Roku increases the gross margin. The GM increased to 44% in 2019, up from the 30% range a couple of years ago. Continued GM increases can allow the company to reach positive earnings in about 2 years. The anticipation of future profitability along with Roku's strong revenue growth has a good chance of driving the stock for above-average gains over the next couple of year

随着 Roku 毛收入的提高,盈利能力也在增强。在 2019 年,Roku 的毛利润从过去几年的 30%,增长到 44%。毛利润的持续增长,让 Roku 在大约两年内能盈利。在未来几年里,由强劲的收入增长带来的预期盈利能力,让 Roku 有很好的机会驱动股价高于平均增速。

Roku's Valuation / Roku 的估值

Since Roku isn't profitable yet, the price to sales ratio is a reasonable metric to use because it is based on revenue instead of earnings. Keep in mind that Roku tends to maintain an above-average valuation. The reason for that is because investors tend to price a premium into the stock, encompassing the company's above-average revenue growth.

由于 Roku 还没有盈利,股价与每股销售收入的比率(市销率)是一个合理的度量方式,因为它是基于收入而不是收益。记住,Roku 的估值往往高于平均水平。这是因为投资者往往把溢价包含在股价中,包括公司高于平均水平的收入增长。

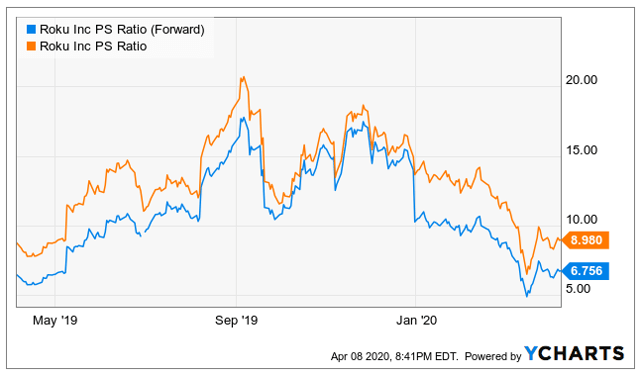

Roku is currently trading with a trailing price/sales ratio of 8.9 and a forward price/sales of 6.7. This is still above the S&P 500's average price/sales ratio of 1.97. However, Roku's price to sales ratio improved significantly since it was in the teens in Q4 2019 as displayed in the chart below:

Roku 目前的历史市销率是 8.9,预期市销率是 6.7。这仍然是高于标普 500 的平均市销率1.97。然而,从2019 年 Q4 从 10 开始,Roku 的市销率会明显改善,如下表展示:

Source: YCharts

Source: YCharts

The reality is that some stocks will maintain an above-average valuation over long periods of time. Roku happens to be one of them as revenue growth has been growing at a strong double-digit annual pace. Roku can probably be placed in the category of outlier stocks like Netflix (NASDAQ:NFLX) and Amazon which have maintained higher-than-average valuations over many years.

现实是,在很长一段里,有一些股票将维持在高于平均水平的估值中。Roku 恰好是它们中的一员,因为它的收入以每年两位数的速度强劲增长。Roku 很可能被归类到这些“离群”的股票中,就像奈飞和亚马逊一样,它们维持高估值很多年。

Netflix and Amazon had many years where they were growing revenue at above-average paces while their valuations were sky-high. Value investors shunned these stocks for years at their own missed opportunity cost. Even Warren Buffett admitted that he missed out on Amazon's stock growth.

奈飞和亚马逊的收入增长,很多年来都高于平均水平,同时估值极高。价值投资者多年来回避这些股票,错失了机会成本。甚至沃伦巴菲特也承认他错过了亚马逊。

Value investors can be quick to say that Roku's value is too high and that the company is not yet profitable. That's true based on standard metrics. However, you have to visualize the future to get the bigger picture of the stock's true potential.

价值投资者能快速的说 Roku 的估值过高,并且公司还没有展现盈利能力。基于标准的度量标准,这是对的。但是,你必须得目光放长远点,才能看到股票真正的潜力。

Roku has been improving its prospects for profitability. Continued gross margin gains have Roku on track for positive earnings in about 2022. The company is likely to continue growing revenue at a strong pace due to the trend of cord-cutting. Therefore, buying the stock on the current dip in valuation during a period of market weakness can provide a good entry point for a long-term position.

Roku 一直在改善盈利前景。持续的毛利润增长使得 Roku 有望在 2022 年取得盈利。在去有线的趋势下,Roku 以很快的速度在收入上取得持续的增长。因此,在市场低迷期间,在目前的低估值点买入 Roku,在很长一段时间内,都是一个很好的机会。

Source: Stockcharts

The weekly chart above shows that the stock recently bounced higher from an oversold level on the RSI indicator. However, there is still a lot of volatility in the market. Plus, it might be difficult to pick the bottom for the stock, especially when the market could drop again. With the stock trading about 50% lower than its 52-week high, now is probably a decent time to start a position if you're going to hold onto to it for multiple years.

从上图的周线看,Roku 股票目前从 RSI 指标的超卖水平反弹。然而,市场现在还存在许多波动。另外,抓住股票的底部可能是很困难的,特别是市场可能再次下跌。在股票低于 52 周最高点 50%的情况下,如果你准备在未来几年持有,现在可能是一个合适的买入位置。

Roku's Long-Term Investment / Outlook Roku 长期投资展望

Roku is a company that is likely to grow revenue at a strong pace for multiple years. Many consumers have demonstrated their desire to stream TV content/movies over standard cable services. The amount of U.S. consumers canceling their standard cable-style TV subscriptions and those never getting cable TV subscriptions is expected to grow from 48.9 million to 61.5 million by 2023. This trend is likely to help drive revenue growth for Roku.

在未来几年,Roku 可能会在收入上高速增长。很多消费者证明他们从标准有线服务转向流媒体内容和电影的意愿。美国消费者取消标准有线电视订阅,并且不会继续订阅的数量,在 2023 年,有望从 4890 万增长到 6150 万。这个趋势很可能帮忙驱动 Roku 收入的增长。

Watch for Roku to continue growing revenue by increasing ad dollars, adding new smart TV manufacturers for licensing, and growing the business geographically. Keep an eye on momentum from the competition to see if the investment thesis needs to be changed or modified.

随着广告收入的增长、增加新的智能电视厂商的授权,拓展多地域的商业伙伴,Roku 的收入会继续增长。可以关注竞品的动向,来决定投资主题是否变化或改变。

Investors will have to decide how much volatility they want to bear. You can hold for the long term and deal with the sharp drops that have been characteristic of the stock or be more nimble and trade it between oversold and overbought conditions.

投资者将不得不决定多少的波动是他们愿意承受的。你可以长期持有,处理股票的特性带来的大幅下跌,在超卖和超买之间更灵活的处理交易。

Roku's stock has a good chance of outperforming the market over multiple years with above-average revenue growth and the cord-cutting trend as a tailwind. At Margin of Safety Investing, we look for stocks that have a good chance of doubling within a few years, and Roku is one with that potential.

在去有线的有利趋势下,具备高于平均水平收入增长的 Roku,在近几年是一个很好的超越市场的投资机会。在安全投资的边界里,我们在寻找几年内翻倍的投资机会,而 Roku 是具有潜力中的一员。

The 2020s will see the transformation of the economy during the 4th Industrial Revolution. We are also running head first into a wave of and debt driven problems that will need solving. A cautious, but forward looking approach, will be required to thrive in what could be a lost investing decade for many, much like 2000-2009.

在 21 世纪 20 年代,我们将见证第四次工业革命的经济转型。我们还面临一波由人口和债务驱动的问题,还待解决。对大多数人来着,跟 2000-2009 年一样,是失去投资机会的十年,要想蓬勃发展,得使用一些谨慎,但向前看的方式来解决。

Benefit from the insights of Kirk Spano, Dividend Sleuth, and David Zanoni. Get exclusive investment ideas based upon in-depth and up close research that few others do.

我在投资上,受益于Kirk Spano、Dividend Sleuth 和 David Zanoni的真知灼见。获得独家投资的想法是基于深入和密切的研究,很少有人这样做。

英文原文:https://seekingalpha.com/article/4337013-roku-stock-to-outperform-over-long-term